nevada estate tax return

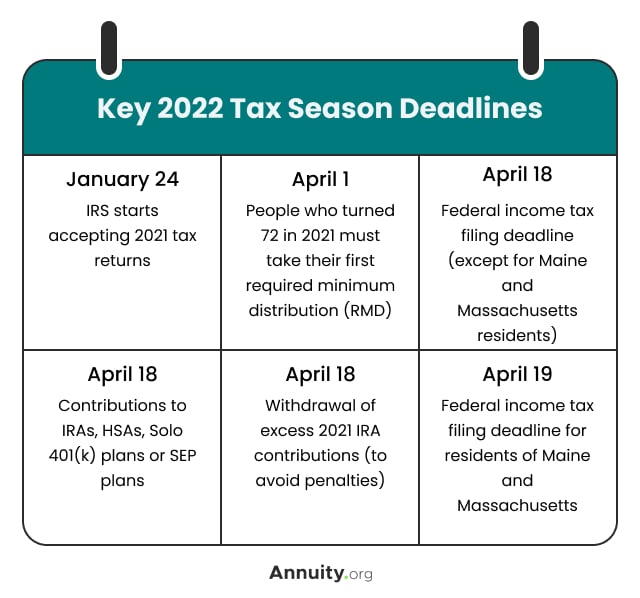

If a death occurred after January 1 2005 you do not need to file an estate tax return with the state. Normally a federal estate tax return is only due if the gross estate plus the amount of any taxable gifts exceeds the applicable exclusion amount up to 117 million in 2021.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Inheritance tax from another state Even though Nevada does not levy an inheritance tax if you inherit an estate from someone living in a state that does have an inheritance tax you will have to pay it even though you live in Nevada.

. Nevada has various sales tax rates based on county. In Nevada transient lodging tax and exemptions are set at the citycounty level and varies by county. An estates tax ID number is called an employer identification.

Review filing payment history. If you have any questions about federal taxes you can contact the IRS at 800-829-4933. Enter your Nevada Tax Pre-Authorization Code.

Before filing Form 1041 you will need to obtain a tax ID number for the estate. Who must file for Estate Taxes in Nevada. Counties can also collect option taxes.

Is a true correct and complete return. All Major Categories Covered. Any specific questions regarding exemptions and rates should be addressed to the citycounty where the hotel is located.

Federal State Contact Information. Nevada currently does not have an estate tax. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706.

In Nevada transient lodging tax and exemptions are set at the citycounty level and varies by county. The estate tax is on the estate of the deceased person before the inheritance gets disbursed. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Select Popular Legal Forms Packages of Any Category. If you received a Commerce Tax Welcome Letter Click Here. Nevada repealed its estate tax also called a pick-up tax on Jan.

It is one of the 38 states that does not apply an estate tax. Nevada estate tax exemption 2021. Nevada has no personal income tax code.

Clark County Tax Rate Increase - Effective January 1 2020. If a death occurred after January 1 2005 you do not need to file an estate tax return with the state. Select the available appropriate format by clicking on the icon and following the on screen.

The federal estate tax exemption is 1118 million for 2018. It is one of the 38 states that does not apply an estate tax. 4810 for Form 709 gift tax only.

An option is given on how to pay this tax. However if your Nevada gross revenue during a taxable years is 4000000 or less you are no longer required to file a Commerce Tax return for 2018-2019 tax year and after. Federal estate tax The federal estate tax will be applied if your inheritance is more than 1206.

A timely filed return is a return filed within nine months after death or within fifteen months after obtaining an automatic extension of time to file from the IRS. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Nevada TX. If the time of death is on or after January 1.

The documents found below are available in at least one of three different formats Microsoft Word Excel or Adobe Acrobat PDF. Sales Tax can be paid on the total cost at time of purchase of the property or Sales Tax can be collected from the customer on the total lease or rental charges within this State. Department of the Treasury.

The decedent and their estate are separate taxable entities. Normally a federal estate tax return is only due if the gross estate plus the amount of any taxable gifts exceeds the applicable exclusion amount up to 117 million in 2021. NRS 372060 372085 372105.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. 8192005 31444 PM. The personal representative of every estate subject to the tax imposed by NRS 375A100 who is required to file a federal estate tax return shall file with the Department on or before the federal estate tax return is required to be filed any documentation concerning the amount due which is required by the Department.

Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author. The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience. Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author.

If your Nevada gross revenue during a taxable year is over 4000000 you are required to file a Commerce Tax return. But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates. If you have any questions about state taxes you can contact the Nevada Department of Taxation at 866-962-3707.

I am a small business owner and my revenue is less. Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value. It gets paid out of the estates funds.

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. For further information on Lodging Tax Authorities please contact our Department at 775 684-2000. Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value.

Ask the Advisor Workshops. Get Access to the Largest Online Library of Legal Forms for Any State. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

This can make the combined countystate sales tax rate as high as 810 in. Ad Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Under Nevada law there are no inheritance or estate taxes.

Nevada filing is required in accordance with Nevada law NRS 375A for any decedent who has property located in Nevada at the time of death December 31 2004 or prior and whose estate value meets or exceeds the level requiring a Federal Estate Tax return. Click here to schedule an appointment. IRS Form 1041 US.

Their hours are 7am to 7pm Monday through Friday Pacific Time. Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author. So even though Nevada does not have an estate tax gift tax or inheritance tax it does not mean that she won.

Nevada does not have an inheritance tax either. Sales tax is due from the lessee on all tangible personal property leased or rented.

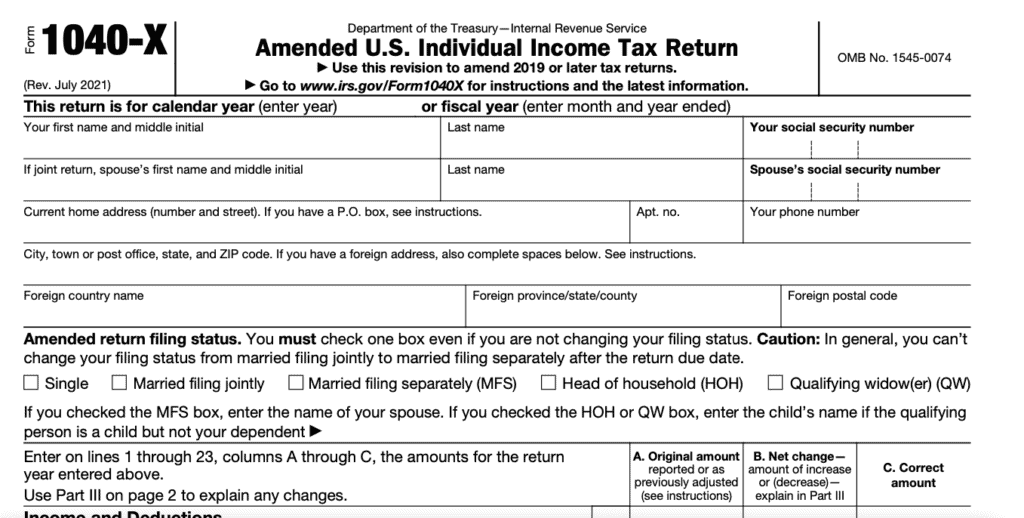

How To Easily Amend Tax Return Before Irs Catches Your Mistakes Internal Revenue Code Simplified

Filing Taxes For Deceased With No Estate H R Block

You Made A Mistake On Your Tax Return Now What

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

2022 No Tax Return Mortgage Options Easy Approval

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Tax Form Templates 5 Free Examples Fill Customize Download

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

How To File Llc Taxes Legalzoom Com

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

How To File Taxes For Free In 2022 Money

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Understanding The 1065 Form Scalefactor

Here S The Average Irs Tax Refund Amount By State Gobankingrates

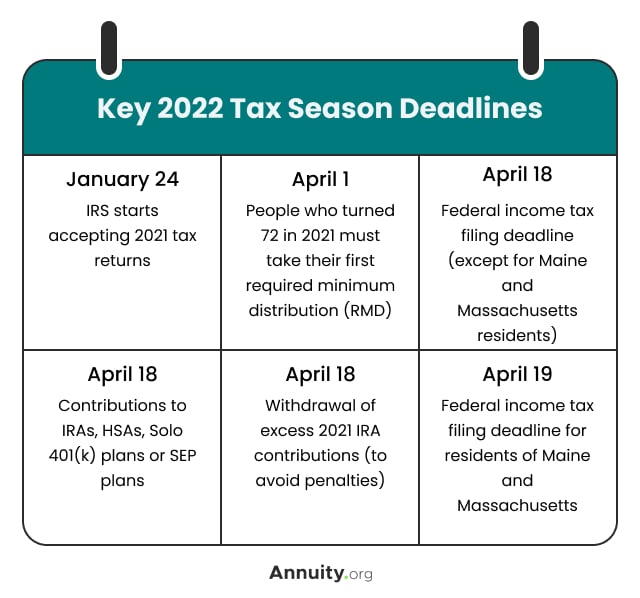

2022 Filing Taxes Guide Everything You Need To Know

Irs Tax Penalties Tax Lawyer Tax Attorney Family Law Attorney