reverse sales tax calculator texas

You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula. The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax You can calculate the reverse tax by dividing your tax receipt by 1 plus the percentage of the sales tax.

Reverse Sales Tax Calculator Calculator Academy

That entry would be 0775 for the percentage.

. 1 The type of taxing unit determines which truth-in-taxation steps apply. Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681. Thus you can compute the actual price and the sales tax charged on it out of a products post-tax priceThe formula for computing the actual sales price is easy.

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts. Following is the reverse sales tax formula on how to calculate reverse tax.

This script calculates the Before Tax Price and the Tax Value being charged. This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. You can use this method to find the original price of an item after a discount or a decrease in percentage.

Please note that special sales tax laws max exist. To add tax to the price of an item multiply the cost by 1 the sales tax rate as a decimal. Vermont has a 6 general sales tax but an.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Enter the total amount that you wish to have calculated in order to determine tax on the sale.

Tax 248 0075. Subtract the discount rate from 100 to acquire the original prices percentage. Current HST GST and PST rates table of 2022.

Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes. Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax.

In Texas can a reverse mortgage be approved if. Now find the tax value by multiplying tax rate by the before tax price. Price before Tax Total Price with Tax - Sales Tax.

To easily divide by 100 just move the decimal point two spaces to the left. Here are the steps. In Texas prescription medicine and food seeds are exempt from taxation.

In Texas prescription medicine and food seeds are exempt from taxation. For example if the full payment is 5798 and you paid 107 sales tax you can enter these numbers into our calculator to determine your original pre-tax price. Reverse Sales Tax Calculations.

The sales tax you pay is based on auto tax regulations in your municipality and is not typically influenced by whether the car is new or used. Your sales tax would be 20000 times 6 percent which equals 1200. Like income tax calculating sales tax often isnt as simple as X amount of money Y amount of state tax In Texas for example the state imposes a 625 percent sales tax as of 2018.

Formulas to Calculate Reverse Sales Tax. Assume your sales tax rate is 6 percent and the purchase price of the car is 20000. Tax rate for all canadian remain the same as in 2017.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Not all products are taxed at the same rate or even taxed at all in a given. Rather than calculating sales tax from the purchase amount it is easier to reverse the sales tax and separate the sales tax from the total.

Enter the sales tax percentage. However cities counties. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax.

For example if you paid 2675 for items and the tax on your receipt was. Before-tax price sale tax rate and final or after-tax price. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations.

OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. Tax 186 tax value rouded to 2 decimals Add tax to the before tax price to get the final price. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax An error margin of 001 may appear in reverse calculator of sales tax.

The next step is to multiply the outcome by the tax rate it will give you the total sales-tax dollars. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate. The final price including tax 248 186 2666.

And all states differ in their enforcement of sales tax. Here is the Sales Tax amount calculation formula. Sales Tax Rate Sales Tax Percent 100.

This calculator allows you to select your loan type conventional FHA or VA or if you will pay cash for the property. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price or in reverse from a tax-included price.

See the article. Cities counties and hospital districts may levy. Calculate Reverse Sales Tax.

Welcome To Montgomery County Texas

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator Calculator Academy

Stripe Tax Automate Tax Collection On Your Stripe Transactions

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator 100 Free Calculators Io

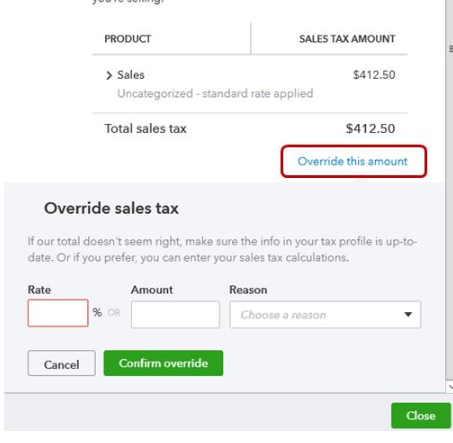

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Texas Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator Calcurator Org

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Reverse Sales Tax Calculator Calcurator Org

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander