are union dues tax deductible 2021

This likely would come in the form of a tax credit or deduction. Under current law no such credit or deduction exists for union dues.

Union Payroll 101 Taxes And Fringes Union Dues Vacation Fund Fca International

New Bill Would Restore Tax Deduction for Union Dues Other Worker Expenses April 21 2021 Four years after the income tax deduction for union dues was ripped out of the.

. Union dues are no longer tax deductible. Employee business expenses are currently not tax-deductible under current federal law as the ability to deduct these expenses has been suspended starting in 2018 and running until 2025. New Bill Would Restore Tax Deduction for Union Dues Other Worker Expenses April 21 2021 Four years after the income tax deduction for union dues was ripped out of the.

Tax breaks for union dues. Reminder Union Dues are Tax Deductible. SOLVED by TurboTax 2961 Updated December 20 2021 No.

Dear Colleagues Just a reminder that as you complete your tax forms for New York State if you. Union Dues Tax reform eliminated the deduction for union dues for tax years 2018-2025. In do i have to sell my stocks to make money fact it is a digital.

When you think the playing field could not be more unbalanced. California along with other states including Pennsylvania and New York already allows union members to lower their taxable income by the amount of their union dues through. Are union dues tax-deductible.

Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union. Even as Democrats prepare major tax increases on corporations capital gains imports and much more theyre also preparing special carveouts for friendly interest. Dems Plan Tax Deduction for Teacher Union Dues.

Posted on 11262021 by Cal Skinner. For tax years 2018 through 2025 union dues are no longer deductible on your federal income tax return even if itemized deductions are taken. A Tax Break for.

However most employees can. Only unreimbursed expenses for books supplies and equipment that you purchased for classroom. New Bill Would Restore Tax Deduction for Union Dues Other Worker Expenses April 21 2021 Four years after the income tax deduction for union dues was ripped out of the.

The short answer is that dues may not be subtracted. Whether union dues adversely affect household cash flow or not the question remains. Per IRS Publication 529 Miscellaneous Deductions.

SOLVED by TurboTax 8016 Updated December 22 2021 If youre self-employed you can deduct union dues as a business expense. Section 138514 of Subtitle I titled Allowance of Deduction for Certain Expenses of the Trade or Business of Being an Employee says The provision allows for up to 250 in. The Center for American Progress a non-partisan public policy organization estimates that an above the line deduction for union dues would amount to approximately 1.

A reminder for tax season. Bitcoin is an innovative payment system that allows for payments to be made with almost any type of currency or commodity.

Union Dues No Longer Deductible Under New Tax Law Don T Mess With Taxes

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Dues Fully Deductible From State Taxes

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Bill Seeks To Make Union Dues Tax Deductible Iam District 141

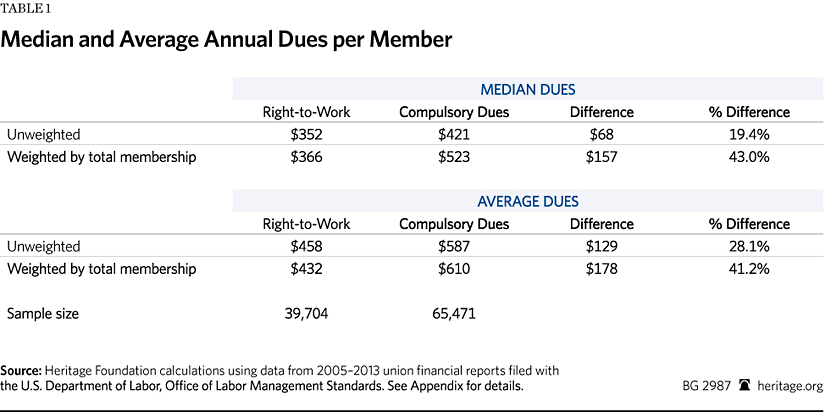

Unions Charge Higher Dues And Pay Their Officers Larger Salaries In Non Right To Work States The Heritage Foundation

:focal(879x824:881x826)/tax-deductions-2000-118868c29f694b2292eda47529a10a89.jpg)

Commonly Overlooked Tax Deductions

Tax Tips Every Nurse Should Know Joyce University

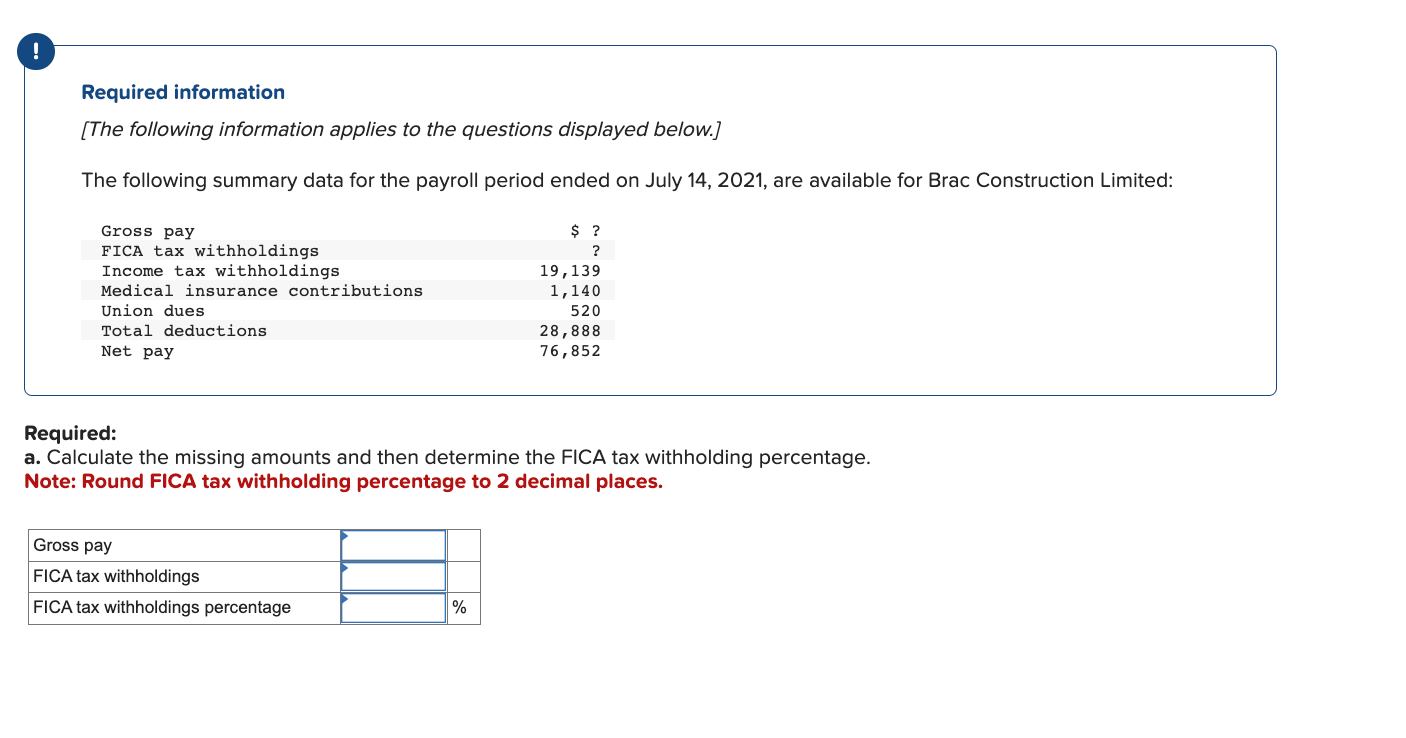

Solved Required Information Skip To Question The Following Chegg Com

Union Station Comments On Proposed Rule Affecting Union Dues Deductions Ballotpedia News

Union Dues Now Tax Deductible Ibew 1249

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

Are Union Dues Check Offs Tax Deductible

Qualified Teacher And Educator Tax Deductions 2022 Returns

Dues Check Off Provisions Once Again Expire With Cba Nlrb Rules Barnes Thornburg